SHARE WITH FRIENDS:

What is a deposit and how to understand it?

Deposit - this is the placement of funds in the bank for a certain period of time with or without interest.

What types of deposits are available?

The most common types of deposits in Uzbekistan are:

-

-

demand deposits. They do not have a strictly limited time limit for funds and the depositor can withdraw his funds at any time. In practice, interest rates on demand deposits are lower or interest-free than interest rates on other types of deposits;

-

-

term deposit (deposits for a certain period - 3, 6, 9 months, years or more). In this case, the deposit amount will be refunded after the expiration of the period specified in the contract between the bank and you. Accrued interest can be paid during the term of the deposit (monthly, quarterly, etc.) or after the expiration of the term;

-

savings deposits - The peculiarity of this type of deposit is the accumulation and spending of funds for a specific purpose (study, car, purchase of an apartment, etc.). The deposit is placed for a certain period of time (usually a long time) and it is possible to replenish it, which is not available in all types of deposits.

What is the advantage of a deposit as a financial asset?

Term and savings deposits - is a reliable way not only to save, but also to increase savings. You deposit a certain amount of money in the bank, and the bank pays you interest for the period in which the funds are stored.

For example, if you put your money in a bank deposit at 14% per annum with an annual inflation rate of 18%, you will not only protect your money from inflation, but also earn 4% income. Another important factor is the protection of deposits under state guarantees.

Remember! In case of revocation of the bank's license, the deposits of citizens in the bank by the state are theirs in full, regardless of size and currency return is guaranteed.

What is the term (term) of deposits?

Deposit term - this is the term specified in the agreement between the depositor and the bank for the storage of your funds in the bank. Upon expiration of the deposit, the bank must return the funds to the depositor.

Important !!! Interest paid on early withdrawal of the deposit will be refunded. Each bank has its own conditions for early withdrawal of deposits, which are specified in the contract between the bank and you.

What is the interest on the deposit?

This is the amount of money paid by the bank for the use of your funds. To simplify the calculations, the concept of annual interest rate is applied, i.e. the profit that the bank must give to the depositor for the use of his money during the year. The interest calculated will vary depending on the amount of your deposit and the number of days in the month.

Which method of calculating interest is more useful?

There are the following types of interest rates:

Normal interest rate (also called nominal interest rate)

Simple interest - interest based on the amount of the deposit.

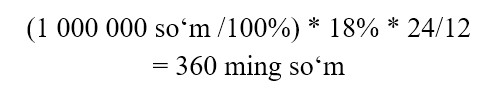

For example, you have a 2 year term 18% per annum at the rate of 1 mln. You opened a deposit in the amount of UZS:

-

A year later SThe trail will cost 1 soums

-

Deposit term At the end of the project, the total amount will be 1 soums, ie interest will be only 360 million soums. is calculated for UZS.

Interest on the deposit (income) is calculated on the basis of the following formula:

(deposit amount / 100%) * interest rate * deposit term (number of months) / 12

|

|

|

Compound interest rate (capitalization)

Interest capitalization This means adding interest accrued in the specified periods (monthly, quarterly, annual) to the principal amount of the deposit.

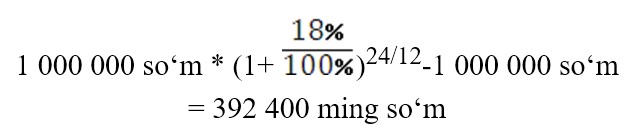

For example, you can pay $ 2 million for a period of 18 years at a compound interest rate (annual capitalization) of 1% per annum. You opened a deposit in the amount of UZS:

-

In a year you will have 1 soums

-

At the end of the second year, you will receive 1 soums, because in the second year, 392% of the initial 400 mln. not for UZS, but for 18 UZS

Interest on the deposit (income) is calculated on the basis of the following formula:

Deposit amount * (1+ interest rate on deposit / 100%) Deposit term (number of months) / 12 - deposit amount

|

|

|